Is Recession Coming in 2025? Stock Market Trends Revealed !

Introduction

Hey there! I’m Harshita, today we’re diving into a big question that’s on a lot of people’s minds: Is a recession coming? It’s a topic that can feel a bit overwhelming, but don’t worry—I’m here to break it down for you in a simple, friendly way. We’ll look at the latest stock market trends, dig into some data, and figure out what it all might mean for the future.

So, grab a coffee, get comfy, and let’s explore this together!

Table of Contents

What’s a Recession, Anyway?

Before we jump into the stock market stuff, let’s get clear on what a recession actually is. Simply put, a recession happens when the economy shrinks for a while—usually two quarters (six months) in a row. It’s measured by something called Gross Domestic Product (GDP), which is like a scorecard for how much stuff a country makes and sells. When GDP goes down, people might lose jobs, businesses struggle, and spending slows.

But here’s the thing: recessions don’t just pop up out of nowhere. There are usually signs—like warning lights on a dashboard—and the stock market is one place we can look for clues. So, let’s see what’s happening there in March 2025 and what it might tell us about a recession.

Why the Stock Market Matters?

The stock market is like a giant mood ring for the economy. When people are feeling good about the future, they buy stocks, and prices go up. When they’re worried, they sell, and prices drop. It’s not a perfect crystal ball, but it can give us hints about where things are headed.

Right now, in March 2025, there’s a lot of chatter about whether the stock market is signaling trouble. Some experts say yes, others say no. To figure it out, we’ll look at key trends, back them up with data, and use some visuals to make it all clear. Ready? Let’s go!

also do check :How to Make Money While You Sleep: A Beginner’s Guide to Passive Income

Trend 1: Stock Market Volatility

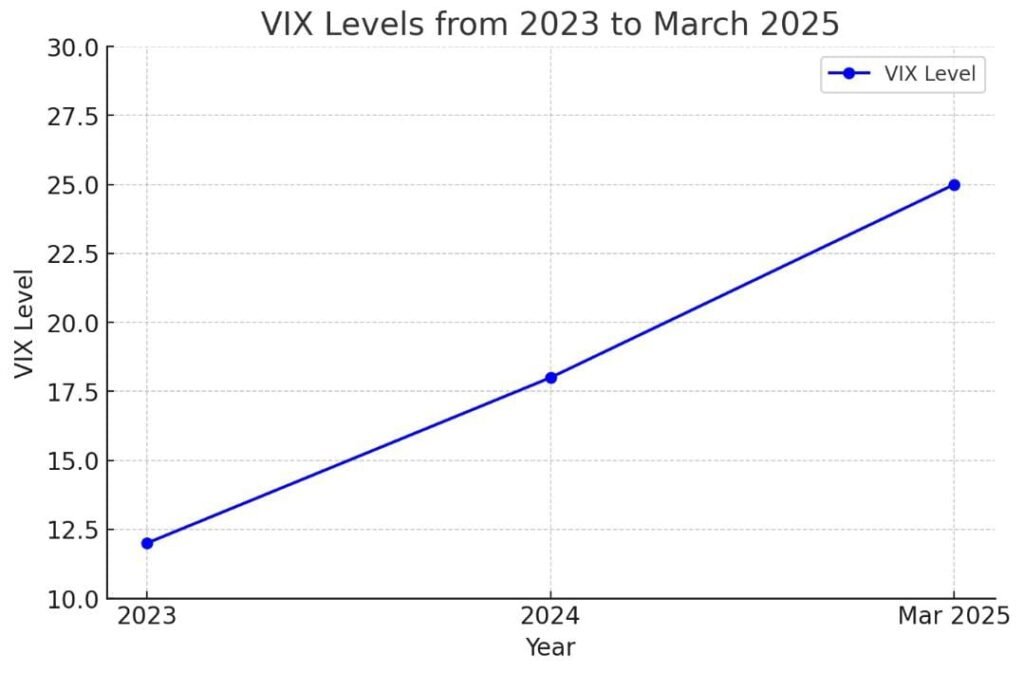

One big thing people are noticing in 2025 is that the stock market has been a bit of a rollercoaster. Volatility means prices are jumping up and down more than usual. The VIX, often called the “fear index,” measures this choppiness. A high VIX means investors are nervous; a low VIX means they’re calm.

As of mid-March 2025, the VIX has been hovering around 20-25, which is higher than the calm days of 2023 when it sat around 12-15. This uptick suggests investors are jittery. Historically, big VIX spikes—like the one before the 2008 recession (when it hit 80)—often come before economic trouble. But 25 isn’t that high yet, so it’s more of a yellow flag than a red one.

Trend 2: Major Stock Indexes Performance

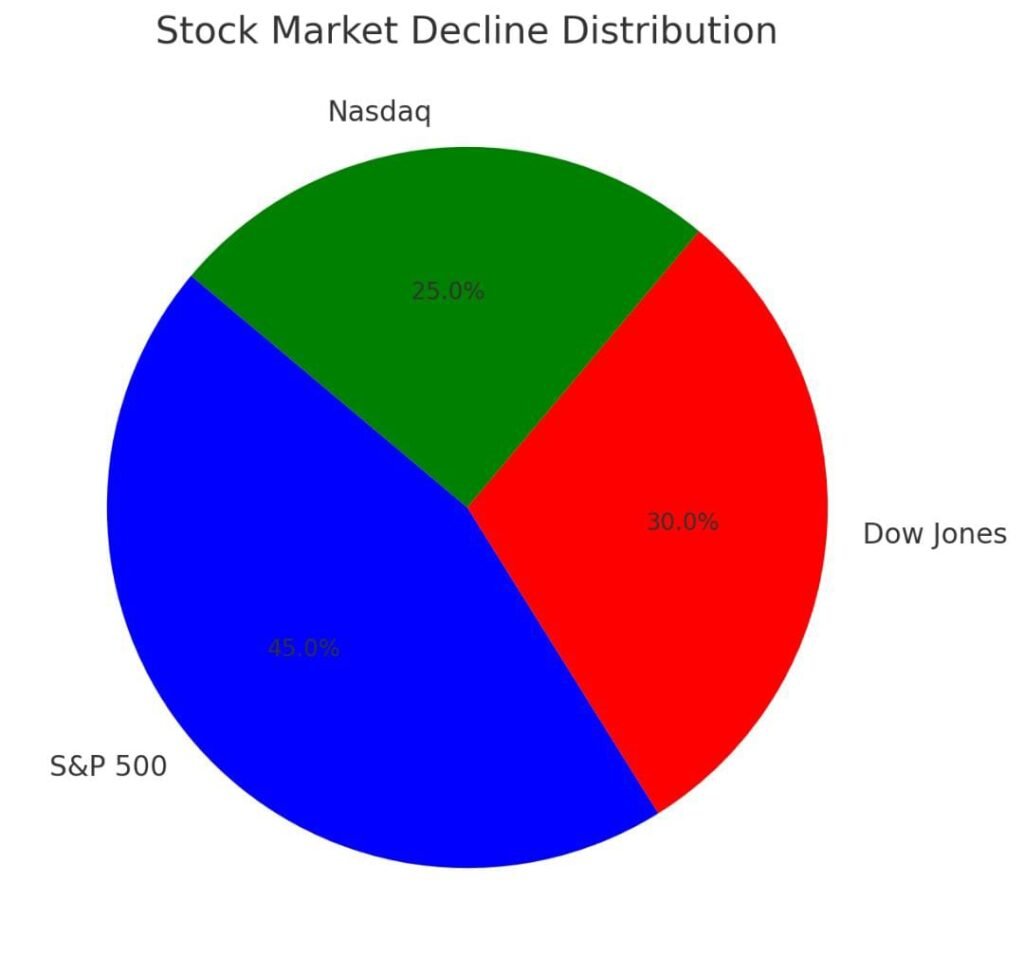

Let’s look at the big players: the S&P 500, Dow Jones, and Nasdaq. These indexes track hundreds of companies and give us a snapshot of the market’s health.

The S&P 500, which covers 500 big U.S. companies, started 2025 strong but has been wobbly lately. By March 14, 2025, it’s down about 5% from its January peak. Here’s a quick table:

| Year | S&P 500 Annual Change | Notes |

|---|---|---|

| 2022 | -19% | Tough year, inflation fears |

| 2023 | +24% | Recovery mode |

| 2024 | +15% | Steady growth |

| 2025 (YTD) | -5% | Volatile, down from peak |

This dip isn’t huge, but it’s worth watching. Before the 2020 recession (caused by the pandemic), the S&P 500 dropped over 30% in a month. We’re nowhere near that yet, but a consistent downward trend could spell trouble.

The Dow, which tracks 30 major companies, is down about 4% year-to-date. The Nasdaq, heavy on tech stocks, has taken a bigger hit—down 7%—because tech companies are sensitive to interest rates and economic slowdowns.

Trend 3: Inverted Yield Curve

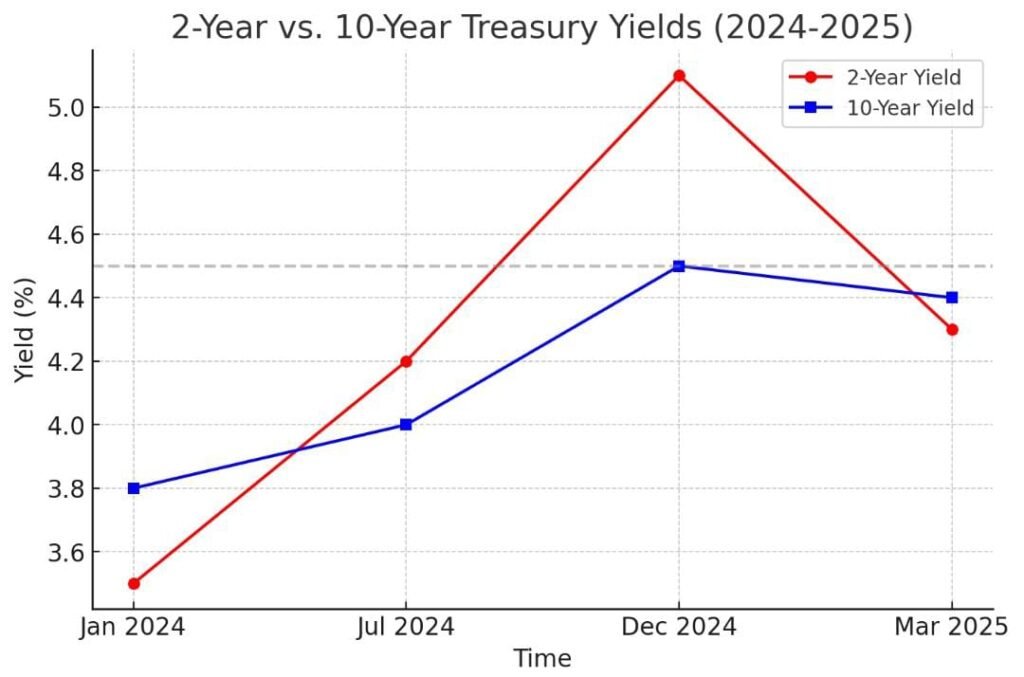

Okay, this one sounds fancy, but it’s simple: the yield curve compares interest rates on short-term vs. long-term government bonds. Normally, long-term bonds pay more because you’re locking your money up longer. When it “inverts”—short-term rates beat long-term ones—it’s a classic recession warning.

In late 2024, the yield curve inverted again, with 2-year Treasury yields at 4.2% and 10-year yields at 3.9%. It’s still inverted in March 2025, though the gap is narrowing. Historically, an inverted yield curve has predicted every U.S. recession since the 1950s, usually 12-18 months ahead. So, if this holds, we might be looking at late 2025 or early 2026 for trouble. But it’s not a done deal—sometimes the curve uninverts without a recession.

Trend 4: Corporate Earnings Slowdown

Companies’ profits (earnings) are another big clue. When businesses make less money, they cut jobs or slow growth, which can drag the economy down.

In Q1 2025, S&P 500 companies reported earnings growth of just 2%, way down from 10% in 2024. Sectors like retail and tech are struggling, while energy is holding up thanks to stable oil prices. Here’s a table:

| Sector | Q1 2024 Earnings Growth | Q1 2025 Earnings Growth | Trend |

|---|---|---|---|

| Technology | 15% | 1% | Sharp slowdown |

| Retail | 8% | -3% | Losses emerging |

| Energy | 5% | 6% | Steady |

| Healthcare | 7% | 4% | Mild slowdown |

This slowdown isn’t screaming “recession” yet, but it’s a sign that companies are feeling some heat, maybe from higher costs or less consumer spending.

Trend 5: Consumer Confidence and Spending

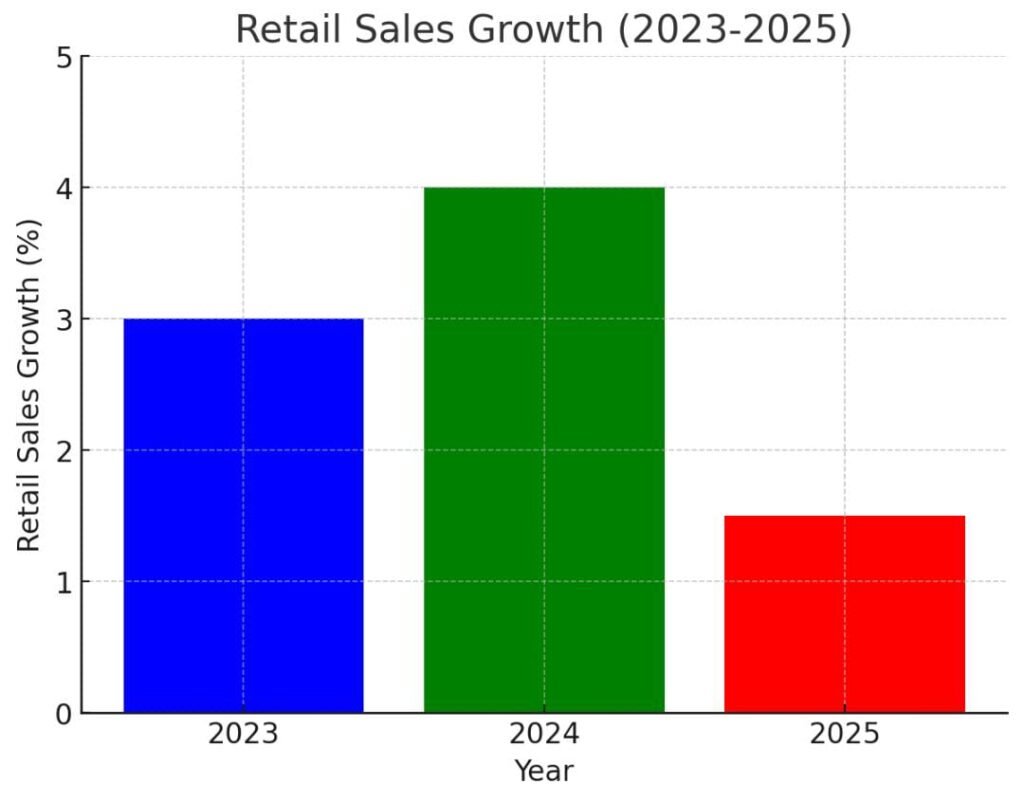

If people stop spending, the economy slows down fast. Consumer confidence—a measure of how optimistic folks feel—has been slipping in 2025. The Conference Board’s Consumer Confidence Index dropped from 110 in December 2024 to 98 in March 2025.

Retail sales grew by just 1.5% in early 2025, compared to 4% in 2024. Lower confidence and spending often signal a recession, but it’s not dire yet—1.5% growth is still positive, just slower.

What History Tells Us?

Let’s put this in context with past recessions:

- 2008 Financial Crisis: Stock market crashed 50%, yield curve inverted two years earlier, consumer spending tanked.

- 2020 Pandemic Recession: Sudden 30% stock drop, no yield curve warning (it was external).

- 2001 Dot-Com Bust: Tech-heavy Nasdaq fell 70%, earnings dried up.

In 2025, we’ve got a mild stock dip, an inverted yield curve, and slowing earnings—not as extreme as those past examples. So, we might be in “watch and wait” mode rather than “panic” mode.

Expert Opinions: What They’re Saying

Economists are split. Some, like those at Goldman Sachs, say there’s a 20% chance of a recession in the next year, citing strong job growth (200,000 jobs added in February 2025). Others, like Morgan Stanley, peg it at 35%, pointing to the yield curve and global slowdowns. Here’s a table:

| Institution | Recession Odds | Key Reason |

|---|---|---|

| Goldman Sachs | 20% | Jobs still growing |

| Morgan Stanley | 35% | Yield curve + global risk |

| JPMorgan | 25% | Mixed signals |

Global Factors to Watch

The U.S. doesn’t exist in a bubble. China’s economy is slowing (growth at 4% in 2025, down from 6%), and Europe’s dealing with energy prices. If these big players stumble, it could drag the U.S. stock market—and economy—down too.

So, Is a Recession Coming?

Here’s my take, as Harshita: We’re seeing some warning signs—volatility, an inverted yield curve, slower earnings, and shaky consumer confidence. But it’s not a slam dunk. The stock market’s down but not crashing, jobs are still growing, and spending hasn’t stopped. I’d call it a “maybe” for late 2025 or 2026, depending on how these trends play out.

What you can do:

- Investors: Diversify—mix stocks with bonds or gold to cushion any dips.

- Everyday Folks: Save a little extra, just in case jobs get shaky.

- Business Owners: Keep an eye on costs and customer trends.

Wrapping Up

We covered a lot! The stock market’s giving us mixed signals in March 2025—some red flags, but nothing screaming “recession” just yet. With graphs, tables, and a bit of history, I hope this made sense and didn’t feel like a textbook. What do you think? Are you worried about a recession, or feeling optimistic? Let me know—I’d love to chat more!

Thanks for hanging out with me, Harshita, on this deep dive. Stay curious, and I’ll catch you next time!